2021. 1. 12. 03:00ㆍ카테고리 없음

Free Church Accounting Software The free basic church accounting and nonprofit accounting that I have discovered are these spreadsheets at FreeChurchAccounting.com. If you need a way to track your church business revenue and expenses and you can't afford to buy a church accounting software package these spreadsheets are wonderful to use. Church accounting software, free download - Jewel Church Accounting System, Free Accounting, NolaPro Free Accounting, and many more programs. Software Solutions for Churches and Ministries - Church Management Systems, Online Giving, Background Checks, Phone Apps, Live Streaming, and Websites.

- Free Accounting Programs For Mac

- Best Church Accounting Software

- Free Church Accounting Software For Mac

- Free Church Accounting Software For Mac Os

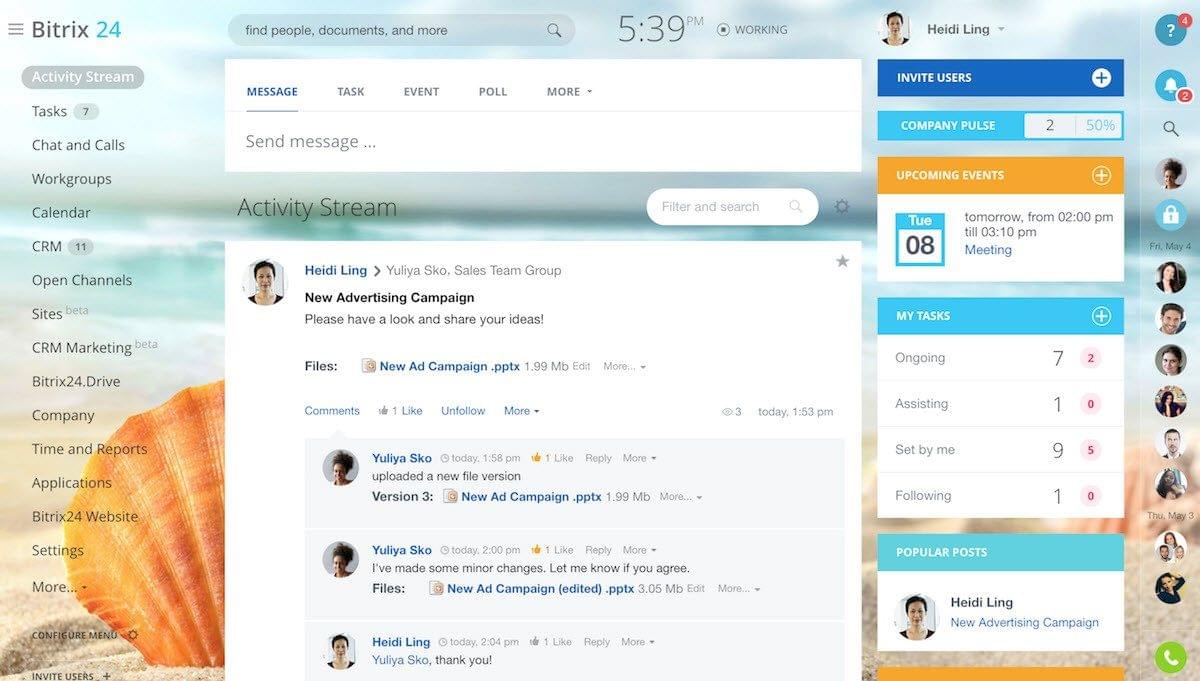

Church accounting software plays an important role in the infrastructure of your church, ensuring you have clear records of all your finances, and that your staff gets paid. Churches have different financial needs and responsibilities than businesses, which is where this specialized software is most helpful.

We’ve prepared a list of the best church accounting software programs to help you choose the one that’s right for you. Since the cost of most church accounting software is based on the specific needs of your church, pricing isn’t always available online—but where it was possible, we’ve included it.

1. Aplos Church Accounting

Price: Not listed

Free trial: 15 days

“‘Aplos’ means simple in Greek and we believe that by creating a software made for the unique needs of churches, we can make it simple for you to do accounting the right way. Tim Goetz, a former executive pastor, founded Aplos Accounting to empower churches to see the exact financial data you need across your organization. Whether that is the expenses applied to your grant across multiple programs or managing the budgets of separate projects, now you can go as high level or as granular as you need.” —from the website

What sets Aplos apart?

Aplos claims to be the #1 church accounting software, and it’s used by more than 20,000 organizations. Here’s what else you should know:

New and small nonprofit discount. Churches and nonprofits formed in the past year can apply to receive six free months. Organizations with less than $50,000 can qualify for a 30% discount.

2. ShelbyNext Financials

Price: Starting at $79 per month

Free trial: No

“Being responsible financial stewards is a vital part of a ministry’s call to serve His Church well. ShelbyNext Financials is a state-of-the-art, cloud-based software specifically designed to meet the needs of churches, ministries, non-profits and denominational headquarters. Available features include general ledger, payroll, accounts receivable, accounts payable and more. Fulfills your financial requirements for governing boards, financial committees, internal staff, and outside agencies. Your auditors will find it easy to complete their tasks because it is FASB 117 and GAAP compliant.” —from the website

3. Elexio Financials

Price: Not listed

Free trial: No

“Created specifically for the needs of churches, ELEXIO Church Accounting Software was designed to manage church accounting simply and powerfully. Fulfilling the needs of your financial committee is easy with this cloud-based software solution.” —from the website

4. FellowshipOne Financials

Price: Not listed

Free trial: No

FellowshipOne Financials is actually powered by Shelby Systems. It’s essentially a FellowshipOne version of ShelbyNext Financials. It has all the same features, but it’s integrated with FellowshipOne’s other church software solutions.

5. ACS Technologies

Price: Not listed

Free trial: No

“Every day tens of thousands of churches rely on ACS church management software and church accounting software to run their church. ACS can either be accessed online via our cloud-based OnDemand service or it can be installed locally throughout your networked church office.” —from the website

6. Quickbooks nonprofit

Price: Starting at $20 per month or $199.95 for desktop software

Free trial: 30 days

“Track donors and programs, maintain budgets and create financial reports for your board and taxes.” —from the website

What sets QuickBooks apart?

QuickBooks specializes in accounting software for all types of organizations. They have over 1.5 million customers. Here’s what else you should know:

Test drive. You can try QuickBooks right now with an instant demo.

7. Church360 Ledger

Price: Starting at $15 per month

Free trial: 37 days

“Church360° Ledger is web-based finance software designed exclusively for churches. It streamlines the accounting process so balancing budgets and managing accounts is simple and intuitive.” —from the website

8. ACTS

Price: Free

Free trial: N/A

“Church accounting and financial management is in fact a complicated and professional work. It usually scare off church workers. When the in/out payments and accounts of the church becomes complex, complete financial statements to auditors will not be easy job. Therefore a good church accounting software is essential. The ACTS church management software comes with an accounting module which is well designed compare with those accounting software in the market and is completely free of charge. It includes church finance and accounting management functions designed properly to handle accounts and year-end financial statements.” —from the website

What sets ACTS apart?

ACTS is a church software program used around the world. Here’s what you should know about it:

Free. ACTS is free forever.

Open source. If you or someone at your church has the expertise, you can directly modify ACTS’s code.

9. Logos Fund Accounting

Price: Not listed

Free trial: No

“You don’t have to be an accountant to manage your organization’s finances; we’ll just make you look like one. LOGOS Fund Accounting is designed for the special needs of churches, schools, and non-profit organizations, giving you the power and flexibility of a high-end fund accounting system with the ease of a check-writing program. Train your staff with one of our certified technicians for best practices, tip and tricks of the trade, software mastery, and more. We are here to support you!” —from the website

What sets LOGOS Fund Accounting apart?

LOGOS has been around for almost 40 years and offers a wide variety of church software products. Here’s what you should know about LOGOS Fund Accounting:

Add-on features. LOGOS Fund Accounting has optional add-on features including accounts receivable, asset manager, and order checks and forms. If you don’t need these features, you don’t have to pay for them.

Know any other good church accounting programs?

If you’ve had a good experience with another software, tell us about it in the comments.

Get ministry news and tips

Free Accounting Programs For Mac

Ministry Advice compiles and creates select how-tos, resources, and tools for Christian leaders.

You can use the form below to join our email list, and you'll hear from us about once per week.

Success!

Accounting for churches and nonprofits is a whole different ballgame than commercial accounting!

Been asked to do the accounting for your church or nonprofit and have no idea where to start?

This site was built for you!

See links below for pages on bookkeeping tips, fund accounting, setting up a petty cash account, understanding financial statements for nonprofits, etc.

Learn Accounting for Churches and Nonprofits:

Accounting is define as a system of recording and summarizing financial (business) transactions in such a way that they can later be analyzed or used to communicate with others.

However, all accounting is not created equally!

Where commercialaccounting’s main focus is onmeasuring profit or loss…fund accounting (used primarily by churches and nonprofits)focuses more on measuring the incoming and outgoing funds to aid in the ethicaland legal responsibilities of the nonprofit.

Learn basic accounting concepts that will help you with that measuring on the basic accounting for churches and nonprofits page listed below.

In the mid 1990’s, the Financial Accounting Standards Board (FASB) issued the Statement of Financial Accounting Standards (SFAS) Numbers 95, 116, 117, and 124. They describe the way nonprofits should account for contributions, present their financial statements, and account for certain investments.

The emphasis of the SFAS financial statement reporting is now on “net assets” classification. Learn the three main categories of net assets on the fund accounting page (link below).

Learn more...

Knowledge of some basic accounting concepts and bookkeeping systems is necessary in order to set up and maintain an accounting system.

Learn the difference between two bookkeeping systems and basic accounting for churches and nonprofits...

Basic Accounting

Fund accounting is an accounting method that groups assets and liabilities according to the specific purpose for which they are to be used.

It keeps restricted and unrestricted funds separate for churches and nonprofits. See this page for more details...

Fund Accounting

Even though each organization's chart of accounts is unique, most nonprofit and churches use a universal numbering system to avoid confusion for your staff, bookkeepers, accountants, and financial institutions.

See tips on building an effective chart of accounts...

I have worked with many churches throughout the years and seen quite a few bookkeeping and accounting errors. Most are unintentional and some are harmless, but some of those bookkeeping errors were devastating to the church.

See five common bookkeeping errors below...

Need help setting up an effective accounting system! Overwhelmed with the accounting part of your ministry? Have a high turnover of individuals keeping the books?

We know that one size does not fit all in bookkeeping and payroll services, so we offer 4 different levels of monthly bookkeeping. We can also set up an accounting system and train you how to use! See more information on our services.

Gifts in-kind are donations of items, use of property, and professional services. Accounting for those non cash donations can oftentimes be confusing.

See how to acknowledge and account for those donated goods and services...

The greatest advantage of having a benevolence fund program properly set up is to ensure donations to that plan will be considered tax-deductible and comply with IRS regulations...

Bookkeeper errors can give you inaccurate data and end up costing your church or nonprofit organization thousands of dollars to 'clean up'. See tips to spot those errors and correct them...

Bookkeeper Errors

A “fund” in church fund accounting is a unique designation of money that is tracked separately that everything else, but is still a part of your larger total. See what pitfalls to watch for in fund accounting...

Church Fund Accounting Guide

A fund accounting system is simply a system of collecting and processing financial information about your church or nonprofit.

Setting up an effective accounting system is one of the most important things you can do for your organization. See tips on setting up the best accounting system for your organization...

Setting up a Fund Accounting System

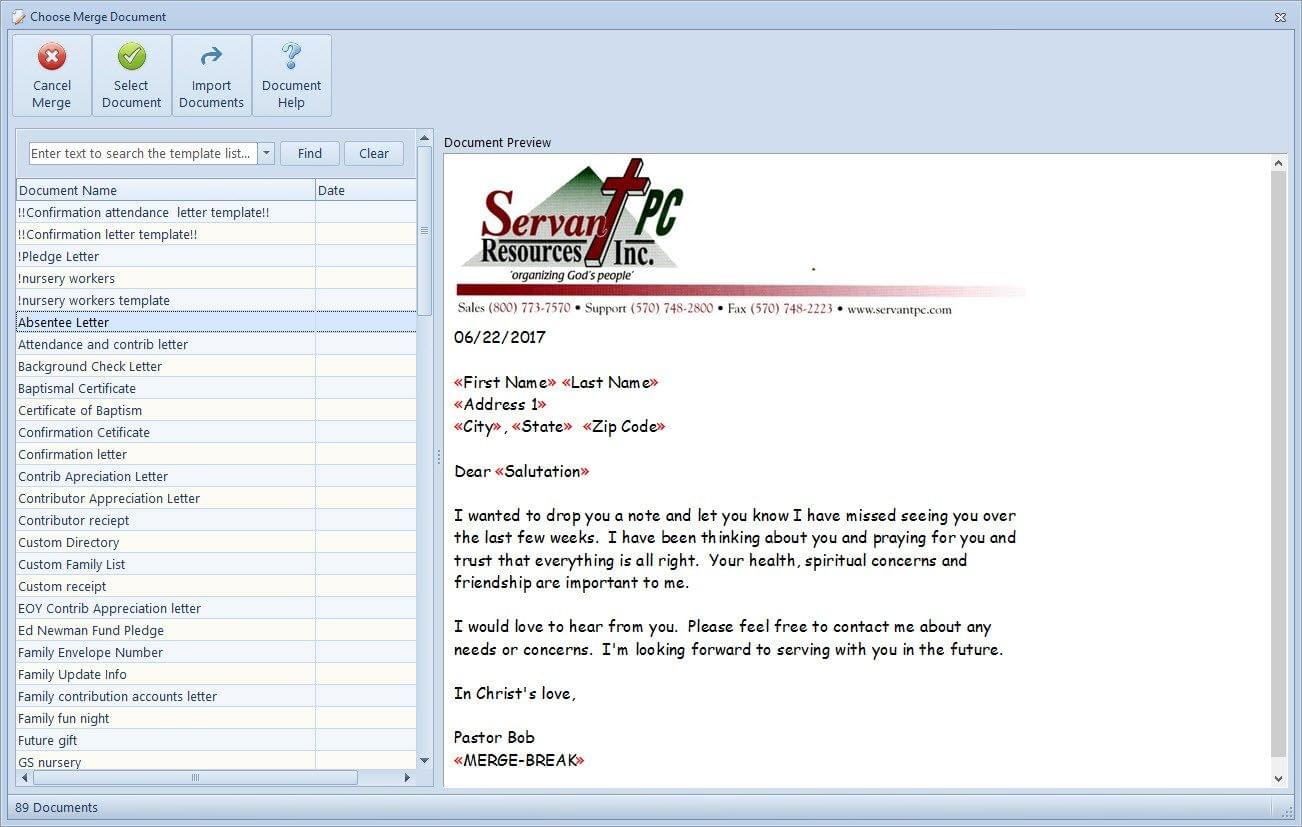

Church Accounting Package

A set of 4 ebooks that covers the following topics...

- Fund Accounting Examples and Explanations

- Setting up a fund accounting system

- Donation management

- Minister compensation and taxes

- Internal controls and staff reimbursements

- Much more - Click here for details

Every church and nonprofit should have a written accounting policy manual.

It will save you future problems down the road and serve as a valuable reference guide for your organization. See how to create one...

Creating an Accounting Policy Manual

The greatest advantage of having a benevolence fund program properly set up is to ensure contributions to that plan will be considered tax-deductible and comply with IRS regulations...

Benevolence Fund Guidelines

Choosing nonprofit or church accounting software for your organization can be a stressful and tedious chore!

You are not looking for the best accounting software on the market. Instead...you are looking for the church fund accounting software that best fits the needs of your particular church...

If your church is embarking on the process of shopping for a new church accounting software, there are a few tips to keep in mind to make it a smart choice. See tips on setting up that new accounting software as well...

Preparing and understanding financial statements for a church or nonprofit organization is easier if you follow this simple rule....

Understanding Financial Statements

Before you generate your financial statements, there is a process you should go through to ensure the accounting reports you give your pastor, treasurer, or governing council is accurate and complete...

Prior to Preparing Financial Statements

See explanations and examples of nonprofit financial statements. Learn what a fund is and what it is not.

Get a workbook with 4 NP financial statements.

Get tips on setting up and maintaining an effective accounting system. See this page for more details...

Basic Fund Accounting Package

A Petty Cash account is easy to set up and will save you from writing a lot of small checks or using your personal funds that you have to be reimbursed for later. First step is...

Nonprofit and church staff and volunteers from all over the world can help each other out with tips, ideas, comments, and questions on this page...

Definitions to help you better understand the accounting terms used on this site.

Nonprofit Accounting Definitions

Best Church Accounting Software

Need training on how to use QBO or Aplos effectively for a church or better yet ...need an expert in either of those accounting software to do your monthly bookkeeping and/or payroll? See more on our accounting services!

Free Church Accounting Software For Mac

Free Church Accounting Software For Mac Os